Early Oct this year, the precious metals gold and silver experienced

a massive tank. Spot Gold plunged 6% in 5 days from $1,320/ounce to $1,240/ounce

before settling around $1,260/ounce level.

Spot Silver tumbled 11% in 5 days from $19.25/ounce to $17.10/ounce before

settling around $17.50/ ounce level.

|

| Source Bloomberg: XAGUSD (Silver) 1-mth Chart |

According to King World News, the massive tank early this month was another desperate attack by the Bank of International Settlement, along with some Western central banks and bullion banks, to manipulate the precious metals price lower. Despite the physical market remaining very strong, we saw 1,000 tonnes worth of paper gold, which is over 40% of annual production of gold, being ferociously sold.

With gold and silver

price being at multi-month low, I received many questions asking me whether it is a good time to

invest in these two glittering assets now.

Here are my views on why I had invested in the precious metal during

the plunge.

#1 Strong Demand from the

East

While the West is coordinated to dump paper gold, the East is

aggressively buying physical gold, particularly China, Russia and India.

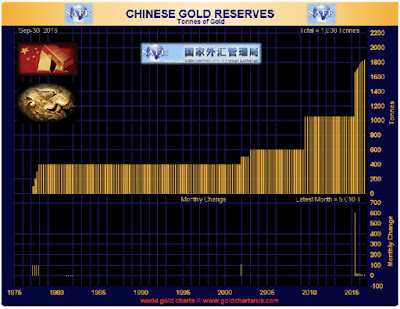

China has been actively buying gold and their holdings have

quadrupled since 2006 to 1,800 tonnes. While China is often seen to

under-report their gold holdings, and given that they have produced and

imported over 11,000 tonnes of gold since 2009, it is believed that their

actual holdings could be as high as 12,000 tonnes.

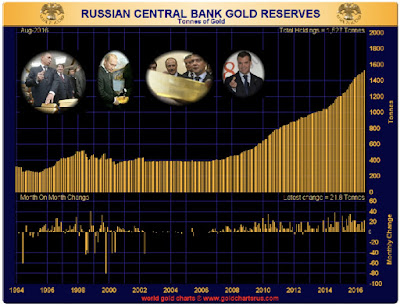

Russia, on the other hand, is often expected to sell their gold when

it comes to economic crisis, such as the recent oil crash. However, if we look

at the Russian Gold Reserves below, we would be surprised to know that the

Russian has been steadily buying gold for the past decade!

Why does the East keep stocking up gold while the West is dumping?

Are they preparing for some catastrophe?

#2 Imminent Economic

Crisis

Most developed economies are so infested with debt that there is

hardly any growth in their economy if the central bank does not use stimulus

plan. US, Europe, Japan, China are just to name a few.

Quantitative Easing (QE) is no longer an unconventional monetary

policy tool because almost every developed country uses it to stimulate growth.

Our economies presently are filled with humongous supply of money, but sadly

very little growth that the FED had to expand QE2 and QE3 to lift the economy.

When digitally printing money provided little effect to the growth, not

only did the central banks come out with Zero Interest Rate Policy (ZIRP), but even

the most ‘creative’ and unprecedented concept of Negative Interest Rate Policy

(NIRP) was introduced to spur their economy.

Can you imagine? When you save money in the bank, you need to pay

the bank the interest.

To get votes, almost all ruling governments in democracy resort to

stimulating the present economies at the expense of our future. Thus, when our

money supply is expanded at a troubling pace, guess what happens to the value

of our money?

It becomes worthless.

Inflation causes the value of money shrinks.

Who will then be the greatest beneficiary?

The true value of wealth – Gold and Silver.

The gold and silver are the natural hedge to inflation. Besides,

these two glittering precious metals have long been a safe haven asset.

Whenever an economic crisis happens, investors tend to dump their risky assets

and flock to safe haven assets.

Unfortunately, we are now engulfed with unprecedented number of risk

events worldwide, e.g. sovereign debt crisis, failure in modern monetary

system, European banking crisis, BREXIT, other European countries independence

referendums, China’s economic slowdown, etc.

When these risk events take place, especially when the monetary

system collapses, the gold and silver will not only skyrocket, but moonrocket

and sunrocket.

In addition, studies show that a major economic crisis tends to

happen in every 10 years.

1987 – Black Monday. Horrible stock market crash

1997 – Asian Financial Crisis

2007 – Subprime Crisis

2017 - ???

What would be the next financial crisis? I don’t know.

When would be the next financial crisis? I don’t know too. But the

odds are it will be in the next few years.

So based on all these potential risks that have been brewing, I

strongly believe the historical high of both gold ($1,917/ounce) and silver ($49/ounce)

will be broken in the next few years, and could test $3,000/ounce. If our

monetary system collapses, the gold could soar to even more unimaginable price.

Buckled up, folks.

#3 Limited Downside Risk

but Great Upside Potential

The production cost of gold is fairly high, averagely at

$1,098/ounce. The breakdown is as below:

In fact, World Gold Council remarked that if the gold price drops

below $1,200/ounce, 30% of the mining companies will be unprofitable and that may

result in production cut. Thus, the supply of gold will be reduced

substantially and the gold price will surge again.

The recent low for gold in Dec 2015 at $1,046/ounce should serve as

a formidable support. As of I am writing, at the current gold price

$1,266/ounce, there is limited downside risk, but great upside potential. If

you miss buying gold below $1,100/ounce level, this plunge is a good

opportunity for you to establish your long position, before short coverings

come.

#4 Diminishing Strength in

USD

The US Dollar has the greatest impact on the

gold price, mainly because the gold price is dollar-denominated worldwide. The

price of gold and the USD exchange rate have a negative correlation of about

80%. In other words, when the USD goes up, the gold price heads down. Unless it

is during financial meltdown that both USD and gold go up in tandem.

So the bigger concern now is: Will the greenback become stronger?

In the medium term, the greenback will be strengthened on the

expectation of the US rate hike, though I believe the strength will be limited.

You see, the Federal Reserve has been calling for a rate hike for

years. After all this while, there is only a mere 0.25% hike. What’s going on?

That is because the Fed knows that the state of the US economy may

not warrant significant rate hike yet. The job growth has not been impressive; the

CPI m/m is still below 0.5%; and the average hourly earnings growth m/m is averagely

0.2%.

The US economy is recovering, but not as fast as it is projected,

that IMF has to revise down the US growth forecast.

The most important economic indicators are job growth and unemployment.

In fact, the non-farm payroll report and unemployment rate that are released by

the US Bureau of Labor Statistics (BLS) every month have significantly

understated the real unemployment rate in the US.

Why?

Because the official US employment data is calculated based on U-3

data, while the true unemployment rate should be based on U-6 data, which

includes discouraged workers and part-timer workforce. Had BLS used U-6 data,

the latest unemployment rate in September 2016 would be 9.7%, instead of 5%.

From the chart below, we see that the U-6 unemployment rate is

consistently double the U-3 unemployment rate. That is why you don’t be

surprised to see much more unemployed Americans in America and to see why

Donald Trump has been able to gain so much support.

For more info about the difference between U-3 and U-6 data, visit here.

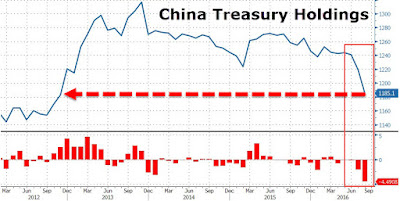

On top of the sluggish US economy, foreign countries are dumping US

Treasuries.

The latest monthly Treasury International

Capital data showed that a massive $346 billion in Treasury selling by foreign

central banks in the period July 2015- July 2016. That is something truly unprecedented

in size and scope – a freaking third

of a trillion in Treasuries sold in the past 12 months!

Among the biggest sellers is China, which has sold a record $34

billion US Treasuries in August 2016, the biggest monthly dump since 2012.

When foreign central banks, sovereign funds, and other financial

institutions are aggressively liquidating US Treasuries, it put significant downward

pressure on the US dollar.

That’s why we always hear the FED talking up the dollar over the

past two years, but end up doing nothing.

Will the Fed raise their Fed Funds rate soon? Yes, probably in a few

months after the US Presidential Election.

Will they raise it aggressively? I doubt so. Because of both

internal economy weakness and external global uncertainties.

That’s why the dollar strength will be capped, and the precious

metals will have a path of lesser resistance to soar.

Based on the 4 reasons above, I believe the gold and silver are

seriously undervalued and have the greatest potential for boom compared to

other asset classes. When the real market forces come into play without the

suppression of price by the central banks, the gold and silver will shine.

P.S. If I am to pick between the two metals to invest, I will choose

silver. Because when Gold/Silver ratio is standing at 72 level high, it just

means that the silver is significantly oversold compared to gold and will

usually appreciate faster than gold when it rebounds. Unlike gold, silver also

has the demand for industrial application.

Disclaimer: The article above is just the author's view and the reader is solely responsible for all the risks and financial resources you use for your trading decision.

wow amazing post.The key points you mentioned here related to maintenance of car is really awesome.Checking all fluid levels,changing oil and of

ReplyDeletecourse the regular service of the car which is necessary to maintain our vehicle.Thank you for the information.

cloud computing training in chennai

You have explained very well. Thanks for your effort..

ReplyDeleteCloud Computing Training in Chennai

Your insights on the current precious metals market, particularly with gold and silver, really caught my attention. Just like investing wisely in assets like these can provide security and growth, seeking online law class help has been crucial for me to stay ahead in my studies and achieve my goals.

ReplyDelete